Make Connections with InsuranceSuite Cloud API

Connect apps and services to InsuranceSuite on Guidewire Cloud Platform.

The InsuranceSuite Cloud API is a set of RESTful system APIs that client applications can use to request data from or initiate action within an InsuranceSuite application. Built specifically for use with Guidewire Cloud Platform, the InsuranceSuite Cloud API enables you to connect apps and services from your enterprise to Guidewire without the need to make changes to the code base. Powerful and flexible, the InsuranceSuite Cloud API offers:

- RESTful API access that exposes Create, Read, Update, and Delete (CRUD) operations on resources

- Easily execute your business flows and transactions

- Reduce cost and effort on upgrades

- The stable and versioned API supports non-breaking changes and seamless upgrades of client applications

- Auto generation of line of business (LOB) APIs provide access to your unique product configurations without coding

Related Info

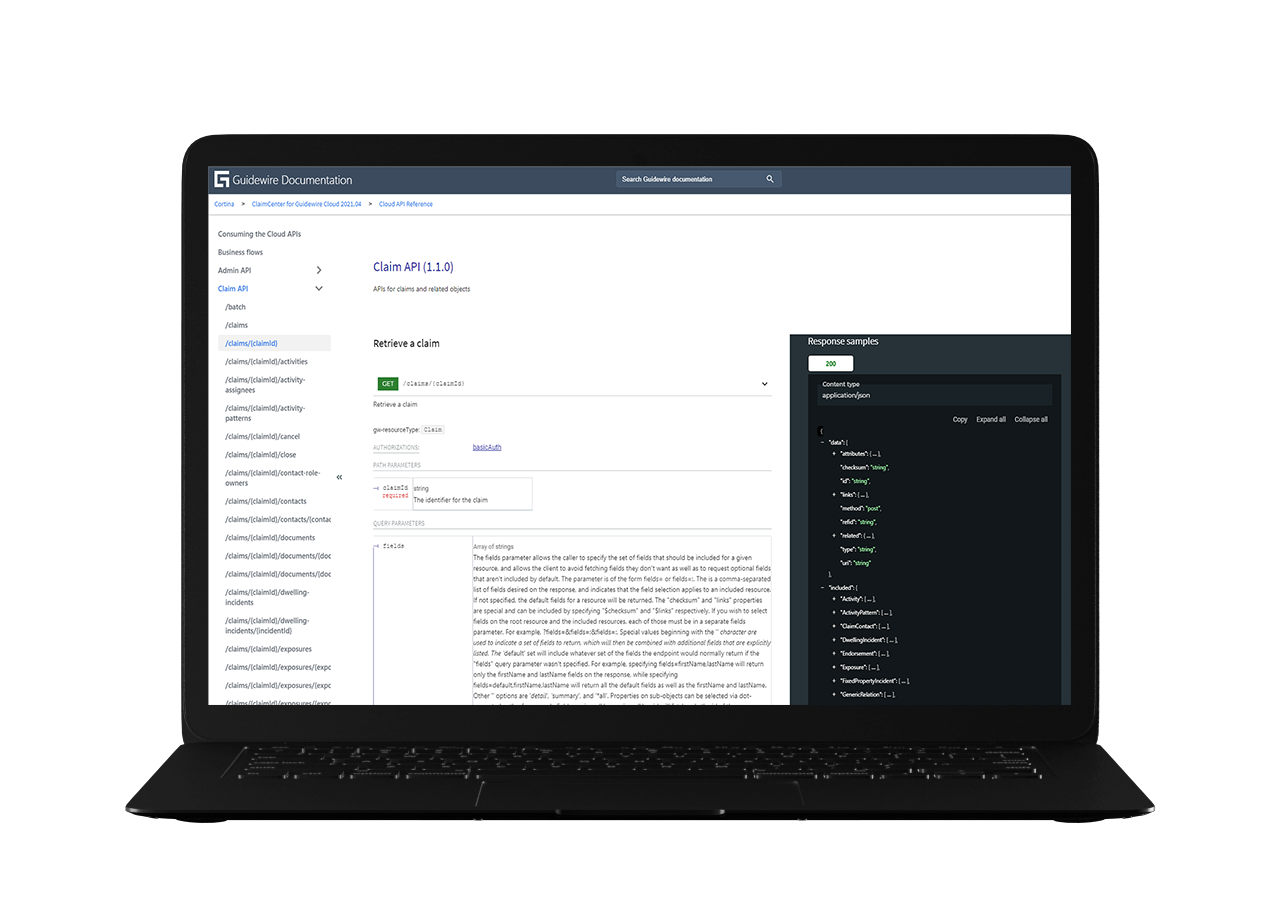

Start building with the API reference for InsuranceSuite on Guidewire Cloud Platform.

Get started exploring the InsuranceSuite Cloud API with publicly accessible API references for ClaimCenter and PolicyCenter. The public display includes all endpoints and provides sample responses. Additionally, you’ll also find select developer documentation related to consuming the API, and executing key business flows with the API.

Note: For PolicyCenter the API reference displays sample out-of-the-box endpoints for common lines of business. Auto-generated APIs for your unique lines of business will vary. InsuranceSuite provides native functionality to view the specific APIs in a configured environment using Swagger UI.

Select an API reference below, or visit the full library of Guidewire API documentation.

View the API Within Your Environment

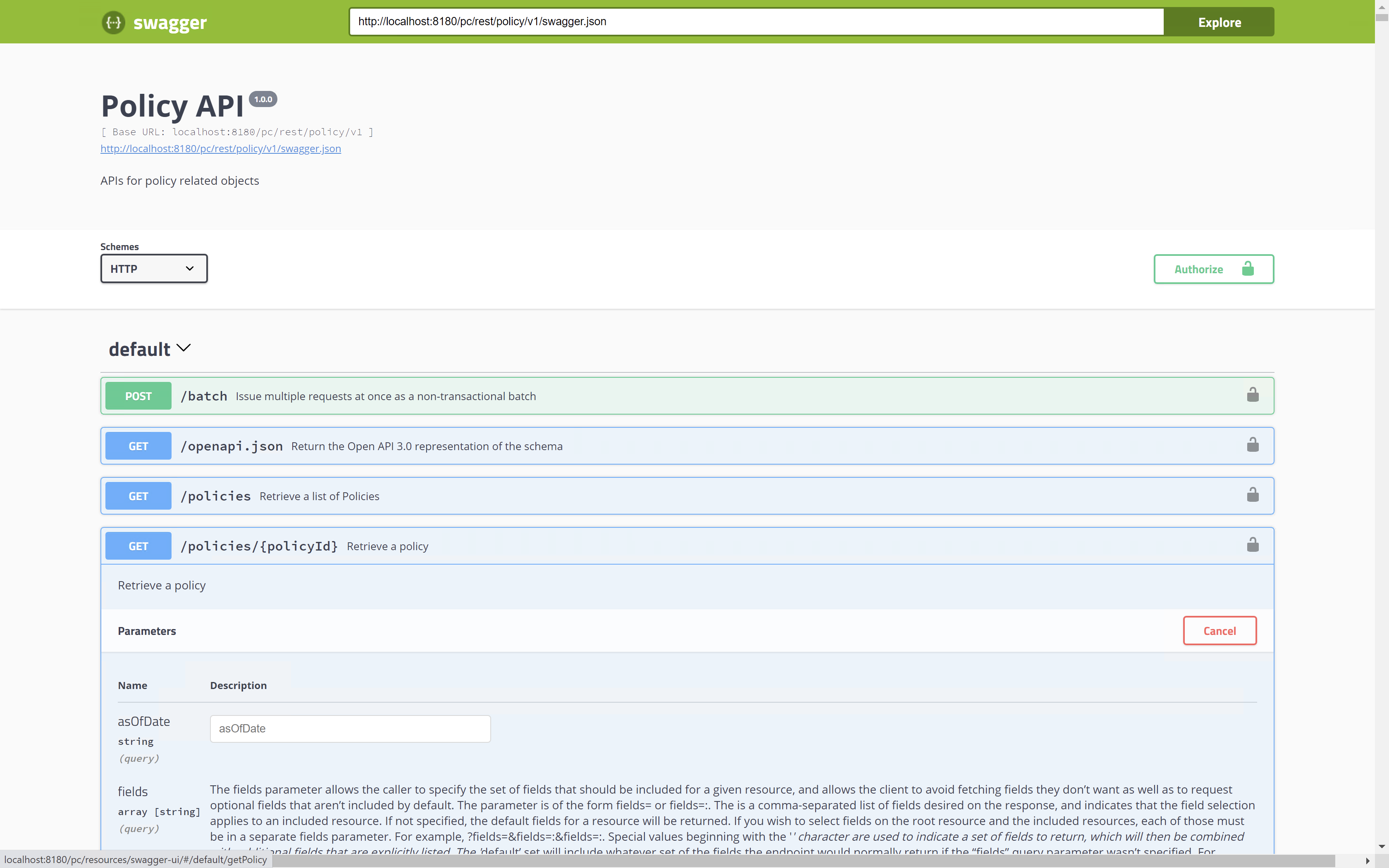

The endpoints and operations for every API are defined in Swagger files. The open source tool Swagger UI automatically presents this information as an interactive web page. Swagger UI is automatically bundled with InsuranceSuite Cloud applications that have the InsuranceSuite Cloud APIs. Easily view endpoints and transaction details for the out-of-the box ClaimCenter and PolicyCenter API, as well as auto-generated APIs from PolicyCenter.

View the API using Swagger UI

Procedure for PolicyCenter

- Start PolicyCenter.

- In a web browser, enter the URL for Swagger UI. This loads the Swagger UI tool.

- The format of the URL is

<applicationURL>/resources/swagger-ui/

- The format of the URL is

- In the text field at the top of the Swagger UI interface, enter the URL that points to the desired API’s swagger.json file. Then, click Explore. For example:

- To view the common API, enter:

<applicationURL>/rest/common/v1/swagger.json - To view the policy API, enter:

<applicationURL>/rest/policy/v1/swagger.json

- To view the common API, enter:

Procedure for ClaimCenter

- Start ClaimCenter.

- In a web browser, enter the URL for Swagger UI. This loads the Swagger UI tool.

- The format of the URL is

<applicationURL>/resources/swagger-ui/

- The format of the URL is

- In the text field at the top of the Swagger UI interface, enter the URL that points to the desired API’s swagger.json file. Then, click Explore. For example:

- To view the common API, enter:

<applicationURL>/rest/common/v1/swagger.json - To view the claims API, enter:

<applicationURL>/rest/claim/v1/swagger.json

- To view the common API, enter:

Viewing the Base Configuration APIs

Swagger UI lists every endpoint in the API and the valid operations for each endpoint. For example:

- You can do a

GETon the/activitiesendpoint. - You can do a

GETand aPATCHon the/activities/{activityId}endpoint.

REST APIs from your specific LOBs

Leverage your existing product lines to generate “LOB-specific” APIs

In addition to the standard endpoints available with Cloud API, PolicyCenter includes a unique capability to generate specific APIs from your installed products. Every product in PolicyCenter consists of one or more lines of business (LOBs). From a technical standpoint, every line of business is implemented through a set of LOB-specific artifacts. This can include:

- Database tables that store LOB-specific information

- LOB-specific PCFs

- LOB-specific reference tables, such as tables that store class codes

When a line of business is exposed to Cloud API, there is an additional set of LOB-specific artifacts: the LOB-specific endpoints. An LOB-specific endpoint is an endpoint that can create, read, update, or delete information for a specific line of business. For every line of business, there are a set of endpoints to work with Line resources and with other LOB-specific resources, such as coverables and locations.

Every insurer develops lines of business for their specific needs. Because of this, insurers must generate the LOB-specific endpoints for themselves after the structure of the line of business has been sufficiently developed.

To learn more about generating and installing LOB-specific endpoints, read our Cloud API Developer Guide on Guidewire Documentation.

Engage customers and partners, deliver service excellence, and make insurance convenient.

Guidewire Digital is a portfolio of transaction applications that allow customers to expose InsuranceSuite functionality online. Guidewire Digital is included with InsuranceSuite on Guidewire Cloud, or can be licensed separately for InsuranceSuite self-managed implementations.

The Digital products are implemented as client-side Single Page applications that are driven from stateless HTTP services. These services are built on top of the InsuranceSuite configuration, exposing APIs specific to the needs of the Digital applications. The Digital Services leverage the InsuranceSuite application APIs. Therefore, subsequent core system changes to business workflow, rules, and product model are reflected in Digital applications with minimum duplication of effort. This allows the applications to be “thin” and minimizes the amount of business logic to be implemented, tested, and maintained outside the core system. The Digital applications provide flow control and presentation management while passing the processing to the core system. This makes the Digital applications easy to learn, extend, maintain, test, and deploy.

The Digital Application architecture focuses on ease of adoption of new web technologies. Developers can utilize existing skill sets to develop a customer experience that is consistent with their brand. The applications deliver an interactive and modern user experience using the latest web development techniques. Mobile applications are developed to be device agnostic through the use of cross-platform standards and frameworks. In addition, the Edge architecture has been designed to allow Digital applications to work seamlessly with the insurer’s existing web and application infrastructure (such as a content management system).